Areas more sensitive to impact from the Covid-19 pandemic, including medtech elective procedures, have experienced heightened volatility and weaker returns during the past two years.

As we look to a future where Covid-19 becomes an endemic, we believe that the medical device segment is primed for a recovery in the year ahead.

After nearly two years of the pandemic, hospitals are financially incentivised to bring back surgical procedures, because they generate much of a hospital’s revenue.

Medtech pipelines remain strong, with companies within the sector coming up with new products to meet unmet medical needs.

We recommend the iShares US Medical Devices ETF for investors looking to play on the recovery of medical devices. The ETF seeks to track US companies that make and distribute various medical devices.

Our 2024 target price is US$71, which offers investors an upside potential of about 14 per cent, based on the closing price of US$62.20 on April 7, 2022.

The rapid initial spread of Covid-19 had resulted in healthcare systems being severely overwhelmed, with resources and staffing being re-directed to address the surge in patients, particularly in intensive care units.

However, an improving Covid-19 situation, driven by higher global vaccination rates and a milder Omicron variant, has brought much optimism to the outlook for medical devices. Elective procedures are expected to pick back up as hospitals begin to resume broader treatment of non Covid-19 patients around the world.

The returns of medical devices/medtech was previously aided by increased R&D spending and steady procedure volume growth resulting from an ageing and chronically ill population. These long-term secular drivers remain in play, and coupled with a strong medtech pipeline, ensures the growth of sector over the medium to long term.

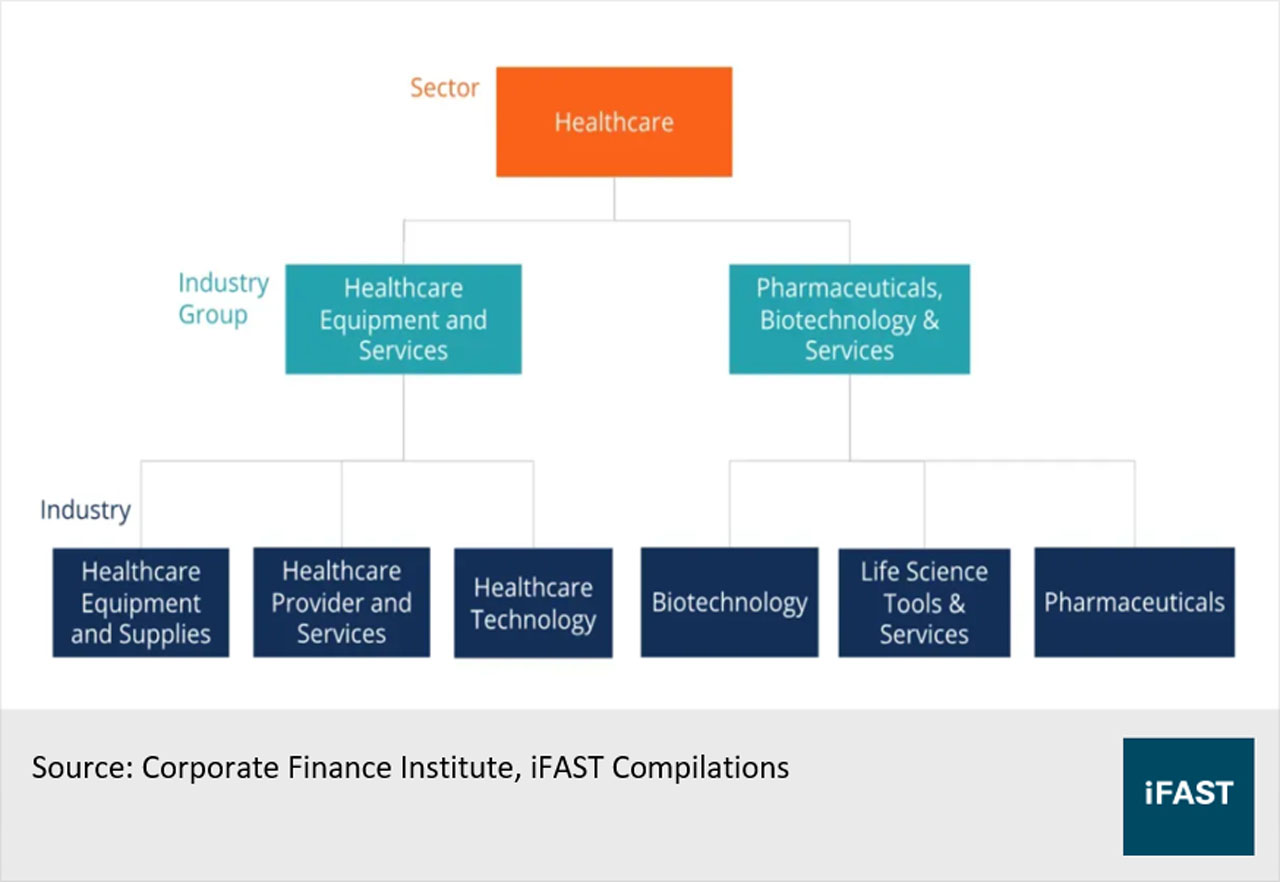

The healthcare sector as defined by GICS.

Underperformance of medical devices in 2021

According to the Global Industry Classification Standards (GICS), the healthcare sector can be broken down into six industries which consists of: healthcare equipment and supplies, healthcare provider and services, healthcare technology, biotechnology, life science tools and services, and pharmaceuticals.

The health care equipment and supplies industry encompasses manufacturers of health care equipment and devices (including medical instruments, drug delivery systems, cardiovascular, orthopedic devices, and diagnostic equipment), with these companies playing a pivotal role in diagnosing and providing quality treatment for patients.

The Covid-19 pandemic has created many pricing discontinuities. Within the medical devices segment, companies like Abbott Laboratories and Becton Dickinson have performed well through the pandemic, as they sold diagnostic tests used to detect the Coronavirus and its various mutations.

At the same time, the pandemic has created challenges for medical device companies reliant on elective procedures. As healthcare systems worldwide scrambled to cope with the waves of Covid-19, many hospitals made the necessary decision to cancel all non-emergency, elective surgical procedures to redirect their resources towards the front line of the pandemic.

Manufacturers focusing on devices used in elective procedures were impacted by the worst months of the pandemic (March to April 2020), and the emergence of deadly new strains like the Delta variant, which peaked between summer and fall 2021 for most countries.

Following a medtech recovery in the summer of 2021, the Omicron variant has also put a temporary hiatus on this momentum. On a whole, this resulted in medical device stocks underperforming the broader healthcare market in 2021.

Underperformance of the medical device segment in 2021.

The return of elective procedures

Procedure volumes have been one of the most-watched topics for medical device companies which rely on surgeries to drive up revenues, such as Medtronic, Stryker Corporation and Boston Scientific.

While 2021 saw a slight uptick in elective procedures, many patients were still reluctant to put themselves at unnecessary risk. Now, in 2022, with the availability of Covid-19 vaccines and anti-viral drugs, patients are likely to be more confident enough to start scheduling these elective procedures.

In the US, the Covid-19 situation is improving, adding to the signs of recovery. Cases, hospitalisations, and deaths are down dramatically from their peaks just two months ago.

Public health experts are feeling hopeful that more declines are ahead. The milder Omicron variant also supports the shift from being in a pandemic to an ‘endemic’, which is more consistent and predictable.

While the periodic resurgence of Covid-19 is expected to have an impact on hospital-based medical device sales, we expect this effect to shrink with time, as serious conditions appear less likely among vaccinated people.

Moreover, patients can only delay care in certain diseases for a certain period of time before it affects mortality rates.

After nearly two years of the pandemic, hospitals are financially incentivised to bring back surgical procedures, because they generate much of a hospital’s revenue.

In the US, it was projected that hospitals nationwide lost an estimated US$54 billion in net income in 2021 as a result of the pandemic. Health systems bring in about US$700 more per admission than emergency room admissions and surgical stays account for roughly 48 per cent of hospitalisation costs.

Taking all this into consideration, we anticipate a strong return of elective procedures moving ahead. Companies reliant on elective procedures would thus be set for a recovery.

2022 is full of new product launches and trials

An ageing global population, coupled with the rising prevalence of chronic diseases, implies a growing number of patients undergoing diagnostic and surgical procedures that involve a range of medical devices. The global medical devices market is expected to grow, with Fortune Business Insights forecasting a growth of 5.4 per cent annually, to reach US$658 billion by 2028.

Companies are continuously coming up with new products to overcome health conditions, and medtech is in the midst of a long-term innovation cycle where new technology replaces legacy devices.

Moreover, with several segments including cardiology, diabetes, spine, and general surgery, still seeing older technology being the standard of care, we expect the innovation cycle to continue for the foreseeable future.

Going forward, medtech pipelines remain strong. In the cardiology segment, Abbott Laboratories expects to see its Aveir pacemaker get FDA approval, while in the diabetes segment, Insulet Corporation has just received its FDA approval for its Omnipod 5 automated insulin pump.

Moreover, the movement towards minimally invasive surgery (MIS) is underway. The shift from open surgery or a big incision to a small incision, in the area of orthopedics for instance, is becoming more prominent.

With MIS, surgeons use a variety of techniques to operate with minimal injury to the body as compared to open surgery.

The shift towards this trend, is further propelled by the growing demand for robotic-assisted surgery. The global surgical robotics market is set to benefit from much growth ahead.

In 2020, the global surgical robotics market generated US$5.5 billion, and is expected to grow at a compound annual growth rate (CAGR) of 10.7 per cent, to reach US$16.8 billion by 2031.

Intuitive Surgical pioneered robotic surgery through the early 2000s, and currently dominates this space with its da Vinci robots. The da Vinci robotic surgical system is able to perform cardiac surgery, colorectal surgery, urology surgery, and general surgery.

Given that the surgical robotics market is growing rapidly, major medical device companies including Medtronic and Johnson & Johnson, have big plans to enter the space and compete.

For instance, Medtronic is entering the surgical robotics market via its Hugo robotic-assisted surgery (RAS) system for minimally invasive procedures, while Johnson & Johnson is similarly doing so with its new robotic surgical system, Ottava.

The launch of such new innovative products would help to drive the revenues and earnings growth of the companies involved, propelling the medical device sector moving forward.

Ride on the recovery of medical devices

We anticipate the recovery of the medical device segment. With increasing vaccination rates, hospitals are likely to be better able to manage Covid-19 cases. They are also financially incentivised to bring back surgical procedures, thereby shifting the priority back to procedures which heavily use medical devices.

Moreover, the growing prevalence of chronic diseases, and the increasing emphasis towards early diagnosis and treatment, are leading to an increasing number of patients undergoing diagnostic and surgical procedures.

Taking this into consideration, we recommend investors the iShares US Medical Devices ETF is a way to participate in this recovery. The ETF seeks to track US companies that make and distribute various medical devices. Prominent holdings include Thermo Fisher Scientific, Abbott Laboratories, and Medtronic. The ETF comes with an expense ratio of 0.41 per cent.

Our 2024 target price for this ETF is US$71, based on a fair PE multiple of 28 times applied to the medical device sector. This translates to an upside potential of about 14 per cent, based on the last closing price of US$62.20 on April 7, 2022.

All in all, as we look to a future where Covid-19 becomes an endemic, we believe that the medical device segment is due for a recovery. Furthermore, a strong medtech pipeline ensures continued innovation within this space, propelling the sector’s growth.