According to a filing on Bursa Malaysia, Dialog will take on 70 per cent participating interest including the operatorship of the Baram Junior cluster small field asset PSC while PSEP will take on the remaining 30 per cent participating interest.

KUCHING (Jan 18): Petroliam Nasional Bhd (Petronas) has awarded production sharing contracts (PSC) to Petroleum Sarawak Exploration and Production (PSEP), a wholly owned subsidiary of Petroleum Sarawak Bhd (Petros), Dialog Resources Sdn Bhd (Dialog), and Dagang NeXchange Bhd (DneX), for two clusters offshore Sarawak.

According to a filing on Bursa Malaysia, Dialog will take on 70 per cent participating interest including the operatorship of the Baram Junior cluster small field asset PSC while PSEP will take on the remaining 30 per cent participating interest.

The 14 years contract comes with a two-year pre-development phase that allows Dialog and PSEP to finalise the field development plan and move into a two-year development phase with first commercial production expected by the end of the phase.

The production phase will continue for the remaining 10 years or up to the expiry of the contract, whichever is earlier.

As for Petros’ contract with DNeX, DNeX’s subsidiary, Ping Petroleum Sdn Bhd (PPSB), signed PSCs with Petronas for the development and production of oil and gas resources in the A Cluster located 290 km off the coast of Miri, Sarawak, offshore Malaysia.

PPSB is the operator of the A Cluster with 70 per cent participating interest, while Petros’ PSEP holds the remaining 30 per cent participating interest.

Petronas awarded the contracts following its Malaysia Bid Round 2022.

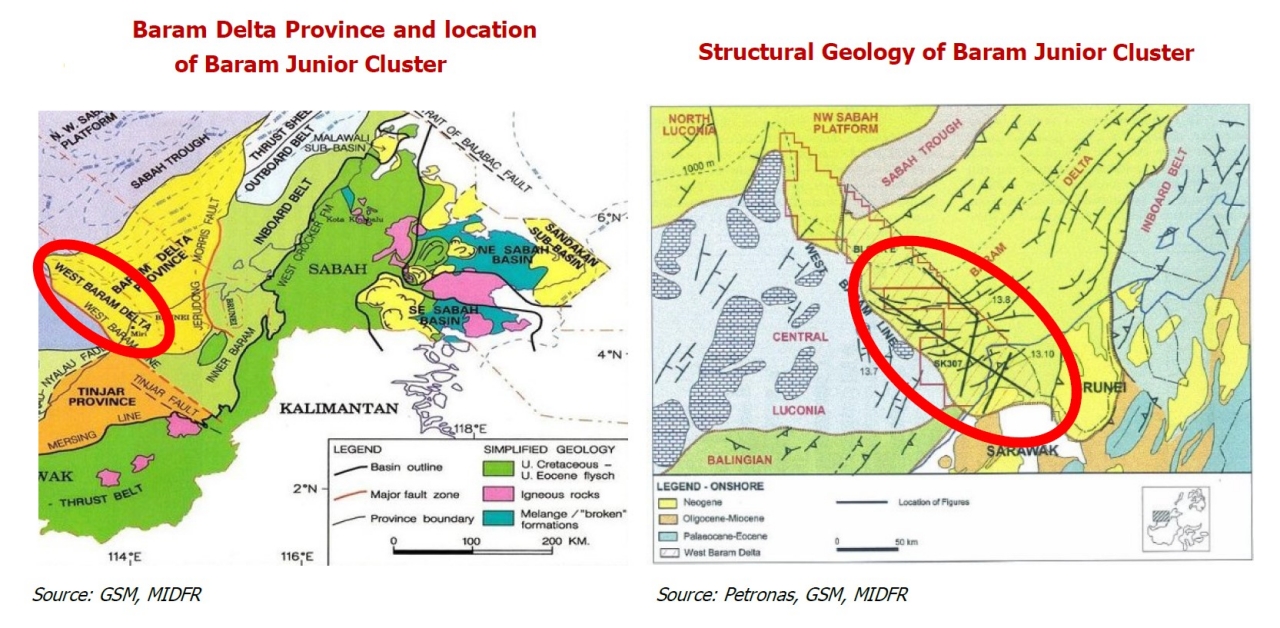

Meanwhile, on the earnings feasibility of the Baram Junior Cluster, the research arm of MIDF Amanah Investment Bank Bhd (MIDF Research) noted that the Baram Junior Cluster is located within the Western Baram Delta in offshore Miri, Sarawak.

It said that the block is known for complex structural geology, formed by paleoregressions of clastic sediments in a deltaic environment.

However, the complex structure opens to high opportunities for hydrocarbon traps in fault-dependent and stratigraphic closures, which makes most of the proven discoveries in the area and its surrounding blocks.

“Additionally, the Baram Junior Cluster has the frontier potential for deep water plays. To date, the Sarawak Basin had produced over 160,000bpd of oil and 4 standard cubic feet (bscf) of gas, with an estimated unexplored prospect of 11 billions of barrels of oil equivalent (Bboe) worth of hydrocarbons.

“The Baram Province also has many more unexplored plays both onshore and offshore, hence, we believe the contract timeline of 14 years is fair and reasonable,” it explained.

However, it also cautioned that the Baram Junior Cluster contract comes with risks that include, but not limited to complex subsurface geology, availability of skilled workers, experts and materials, price volatility of raw materials, and changes in politics, economy and regulations.

“Nevertheless, we believe Dialog is well versed with upstream operations, in terms of exploration, appraisals, special technical services and asset management, hence has the capability to mitigate the risks to Baram Junior Cluster contract,” it opined.

All in, MIDF Research said: “While the Baram Junior Cluster contract is still in its infant stages, we are positive of its development stages and despite the risks, we believe Dialog is capable of undergoing the phases for the Baram Junior Cluster.”