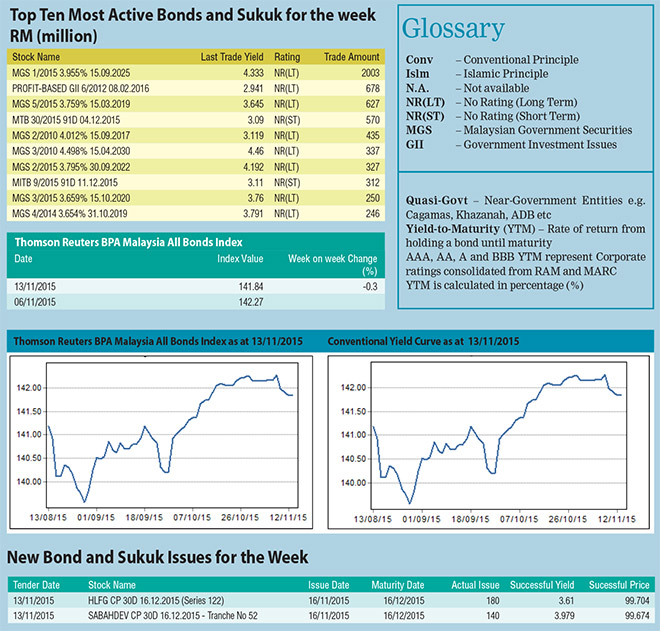

Over the week, the Thomson Reuters BPAM All Bond Index closed a tad lower by 0.3 per cent at 141.84 from 142.27 registered last week. MGS yields surged across the board by four to 20 bps as the ringgit weakened on the back of the upbeat employment data in the US as well as the fall in oil prices.

Over the week, the Thomson Reuters BPAM All Bond Index closed a tad lower by 0.3 per cent at 141.84 from 142.27 registered last week. MGS yields surged across the board by four to 20 bps as the ringgit weakened on the back of the upbeat employment data in the US as well as the fall in oil prices.

Last Friday, the US Bureau of Labor Statistics reported that total NFP increased by 271,000 in the month of October while unemployment rate stood unchanged at five per cent. The NFP data recorded the biggest gain from the 137,000 in September and had significantly surpassed the median estimate of 185,000. This stronger than expected data bolstered the case for rate hike in the next Federal Open Market Committee meeting and triggered more volatility in financial markets.

On November 13, 2015, Bank Negara Malaysia reported that the Malaysian economy expanded by 4.7 per cent in the third quarter of 2015, on the back of resilient private sector demand. On the supply side, expansion was observed in all economic sectors with construction and manufacturing sectors leading the growth while the services sector, mining and agriculture sectors grew at slower pace. Moving forward, domestic demand is expected to remain as the key driver of growth amidst modest performance in the external sector.

The total trade volume for the top 10 most active bonds nearly halved from RM9.78 billion recorded last week to merely RM5.79 billion this week partly due to the Deepavali holiday shortened week as well as cautious sentiments among investors.

The recently reopened 10-year benchmark MGS maturing on September 15, 2025 was the most actively traded with a total trade volume of RM2 billion.

On November 9, 2015, Bank Negara Malaysia announced the tender details for the RM3.5 billion reopening auction of the 10-year benchmark MGS maturing on September 15, 2025.

The tender, which had closed on November 12, 2015, saw weak demand with a bid-to-cover ratio of 1.503 times.

On 12 November 2015, MMC Corporation Bhd issued three tranches of IMTN maturing 2020, 2025 and 2027 with a total issue amount of RM1.2billion carrying profit rate of 5.2, 5.8 and 5.95 per cent respectively.

DanaInfra Nasional Bhd issued a seven-year, 10, 15, 20, 25 and 30-year IMTN with a total issuance size of RM3.1 billion.

On November 13, 2015, Purple Boulevard Bhd (PBB) issued four tranches of rated abs-IMTNs amounted to RM250 million.

Senior Class A MTN was assigned AAA rating and carries profit rate of 5.15 per cent, Senior Class B was rated AA3 with coupon rate of 5.50 per cent, Senior Class C was rated A3 with a profit rate of eight per cent while Danajamin Guaranteed Class D was assigned AAA(fg) with coupon rate of 5.45 per cent.

All these bonds are callable 18 months before their legal maturity and will have their coupon rates stepped up by 1.5 per cent after their respective expected maturity dates.