At the beginning of the week, trading activity in the ringgit bond market was robust as a result of the strengthening of ringgit against the greenback as oil prices rose, following Saudi Arabia’s pledge to work with Organisation of Petroleum Exporting Countries (OPEC) and other oil producers to stabilise global crude oil market.

At the beginning of the week, trading activity in the ringgit bond market was robust as a result of the strengthening of ringgit against the greenback as oil prices rose, following Saudi Arabia’s pledge to work with Organisation of Petroleum Exporting Countries (OPEC) and other oil producers to stabilise global crude oil market.

The Ringgit touched the lowest level at 4.2165 for the month of November on Wednesday.

Another positive catalyst for the week was the announcement of the sale of power assets by 1MDB to China General Nuclear Power Corp for RM9.83 billion early this week. The sale of power assets will pare down some of 1MDB’s debts, alleviating the market’s prevailing concern over the company’s debts.

With the improved positive sentiment, the TR BPAM All Bond Index registered gains of 0.17 per cent to close at 142.44 on Wednesday compared to last Friday’s level at 142.19.

However the bond market turned bearish towards the end of the week with MGS yields rose by four basis points (bps) to six bps across the curve compared to Wednesday’s level as the Ringgit pared gains against US dollar, rising 385 pips on Friday to end the week at 4.26.

As a result of the higher yield movement, the TR BPAM All Bond Index registered lesser gains at 0.1 per cent, ending the week at 142.33.

Over to the US market, a slew of data were released over the week.

Second estimate of US 3Q GDP growth was revised higher to 2.1 per cent q-o-q from an initial estimate of 1.5 per cent. On the other hand, the consumer confidence index had declined further to 90.4 in November following a moderate decline in October (99.1).

Initial jobless claims fell by 12,000 to 260,000 for the week ended November 21, nearing a 42-year low. In spite of the mixed data, results were positive overall, providing US.

Fed with some grounds to lift its benchmark interest rate in the coming FOMC meeting in December.

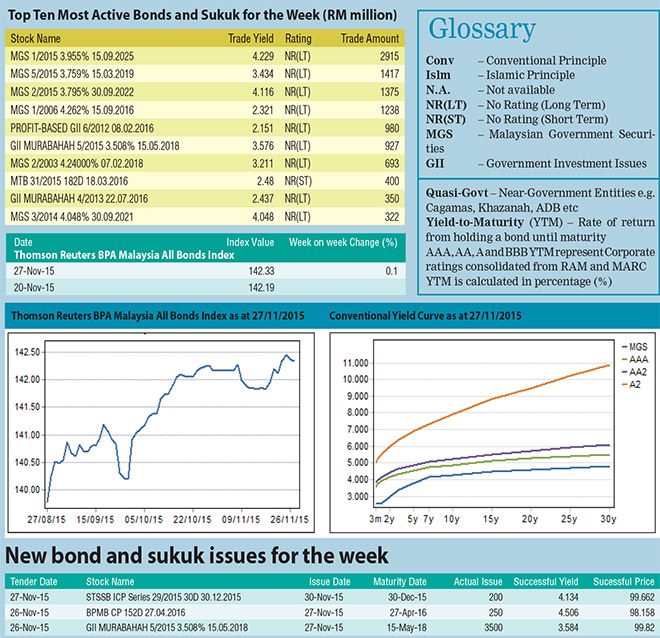

The total trade volume for the top 10 most active bonds increased by 9.32 per cent to RM10.62 billion this week. For the second consecutive week, the 10-year benchmark MGS continued to top the list with RM2.92 billion changed hands.

On November 24, 2015, Bank Negara Malaysia announced the tender details for the RM3.5 billion reopening auction of the three-year benchmark GII maturing on May 15, 2018.

The tender, which closed on November 26, 2015, saw a moderate demand with a bid-to-cover ratio of 1.806 times. The highest, average and lowest yield came in at 3.612, 3.584 and 3.55 per cent respectively.

On November 23, 2015, Poh Kong Holdings Bhd, one of Malaysia’s largest jewellery chain store, issued one tranche of two-year Danajamin guaranteed Islamic Medium Term Notes (IMTN) with a profit rate of 4.75 per cent.

The issuance size was RM10 million and the IMTN is rated AAA(FG) with a stable outlook by RAM Ratings.

On the following day, Malayan Banking Berhad issued a RM220 million 10-year Senior Medium Term Notes (MTN) with a call option starting from the third year onwards.

The MTN carries a coupon rate of 4.65 per cent and is rated AAA with a stable outlook by MARC.

On November 25, 2015, Cagamas Bhd issued five tranches of MTN and one tranche of IMTN with a total issuance size of RM1.2 billion.

The MTNs were issued with tenures ranging from five-year to 20-year that corresponds with coupon rates that ranges from 4.45 per cent to 5.07 per cent.

On the other hand, the five-year IMTN carries profit rate of 4.45 per cent.

The issuances are rated AAA with a stable outlook by MARC and RAM Ratings.